Oct 08, 2023 By Triston Martin

Are you looking to build a diversified stock portfolio but need more time or resources to choose individual stocks? The total stock market index funds may be the perfect choice for you. Total stock market index fund investing allows investors to gain exposure to a wide swath of companies across the entire U.S. equity marketplace with just one investment, giving unparalleled access to markets and adding efficiency and cost savings compared with an actively managed portfolio.

Whether you are familiar with this type of investing or new to it, We will examine some of the best total stock market index funds available today and discuss why they can be a great addition to your portfolio.

What are Total Stock Market Index Funds

Total stock market index funds are passively managed mutual funds or exchange-traded funds (ETFs) that track the performance of a broad, diverse universe of stocks. These investments replicate an entire market index and provide investors access to large companies, small-cap stocks, mid-cap stocks, domestic equities, international equities, and more all in one fund.

This type of investing provides diversification benefits and eliminates the need for investors to research and pick individual stocks, which can be time-consuming and difficult to do correctly.

Vanguard Total Stock Market ETF (VTI)

Vanguard Total Stock Market ETF (VTI) is among the best total stock market index funds available. It offers a cost-effective way to gain exposure to virtually every publicly traded U.S. stock, tracking a portfolio of over 3,500 companies and squeezing out additional returns through its low expense ratio of just 0.03%.

VTI is also one of the most liquid ETFs available, with over $118 billion in assets under management. The fund is also tax-efficient, helping investors maximise their returns.

Schwab U.S. Broad Market ETF (SCHB)

Another excellent option for those seeking for total stock market index funds is the Schwab U.S. Broad Market ETF (SCHB). It offers a very low expense ratio of just 0.02% and tracks the Dow Jones U.S. Broad Market Index.

With more than $15 billion in assets under management and a tonne of liquidity accessible to dealers, SCHB is one of the most well-liked ETFs in its category. The fund is a fantastic option for investors of all experience levels because it also provides tax efficiency and sector diversification.

iShares Core S&P Total U.S. Stock Market ETF (ITOT)

The iShares Core S&P Total U.S. Stock Market ETF (ITOT) is a low-cost fund that tracks the performance of the entire U.S. stock market. It covers over 4,000 stocks across large, mid, and small-cap companies and has an expense ratio of only 0.03%. ITOT is also one of the most popular ETFs in its class, with more than $35 billion in assets under management.

The fund offers investors access to a diversified basket of stocks without researching individual securities, making it a great choice for any investor looking to access the broader U.S. stock market.

SPDR Portfolio S&P 1500 Composite Stock Market ETF (SPTM)

The SPDR Portfolio S&P 1500 Composite Stock Market ETF (SPTM) provides investors a low-cost way to gain exposure to the entire U.S. stock market. The fund tracks the performance of over 1,500 stocks and has an expense ratio of just 0.03%. SPTM is also one of the most liquid ETFs in its class, offering investors plenty of liquidity and low trading costs.

The fund also offers a great mix of large-cap stocks, mid-caps, and small-caps, making it an ideal choice for investors looking to access the entire U.S. stock market with just one fund.

Fidelity Total Market Index Fund (FSKAX)

The Fidelity Total Market Index Fund (FSKAX) is a no-load mutual fund that offers investors exposure to the U.S. stock market at an extremely low cost. It tracks the performance of over 3,500 stocks and has an expense ratio of just 0.015%.

FSKAX also offers great liquidity with more than $80 billion in assets under management and can be used to access virtually every publicly traded company in the U.S. The fund is also tax-efficient, helping investors maximise their returns.

Wilshire 5000 Index Investment Fund (WFIVX)

The Wilshire 5000 Index Investment Fund (WFIVX) is another great pick for investors looking to diversify their portfolios. WFIVX tracks more than 3,500 stocks across the entire U.S. equity market and charges an expense ratio of only 0.06%.

The fund is also quite liquid, with over $20 billion in assets under management, giving investors plenty of liquidity. WFIVX also offers tax efficiency, helping investors realise the full potential of their returns.

Vanguard FTSE Social Index Fund (VFTAX)

The Vanguard FTSE Social Index Fund (VFTAX) is an index fund that tracks the performance of U.S. companies based on the FTSE4Good US ESG Selection Index. The fund seeks to provide investors with broad exposure to socially responsible investing and has an expense ratio of just 0.14%.

VFTAX also offers tax efficiency and low trading costs, making it an attractive choice for investors looking to invest in environmentally and socially responsible companies.

Fidelity ZERO Total Market Index Fund (FZROX)

The Fidelity ZERO Total Market Index Fund (FZROX) is a no-load mutual fund that provides investors access to the entire U.S. equity marketplace with a zero expense ratio. It tracks the performance of more than 3,500 stocks and offers tax efficiency and low trading costs, making it an attractive choice for investors looking for a low-cost way to invest in stocks.

FZROX also has more than $12 billion in assets under management and is one of the most liquid ETFs available, providing investors with plenty of liquidity.

Index investing can offer a great way to diversify your portfolio and access the U.S. equity market with just one fund. Whether you are an experienced investor or are new to index funds, these total stock market index funds can be a great addition to any portfolio. With an array of funds available, you can find one that meets your investment goals and risk profile.

From the low-cost Vanguard Total Stock Market ETF (VTI) to the socially responsible Vanguard FTSE Social Index Fund (VFTAX), there is a total stock market index fund that fits everyone's needs.

FAQS

How do I buy a total stock market index fund?

You can buy a total stock market index fund through your broker or financial advisor. Alternatively, you can purchase them directly from the issuer or on a major exchange such as the NYSE. It is also important to note that many different index funds are available, so research and understand each fund's investment objective before investing.

What is the 5-year return on index funds?

The 5-year return on index funds varies depending on the type of fund and the underlying asset it invests in. Generally, index funds have provided investors with positive returns over the long term, but short-term fluctuations can be short-term fluctuations can lead to losses. It is important to remember that past performance is not a reliable indicator of future returns, so it is best to consult a financial advisor before investing.

Is investing in index funds haram?

No, investing in index funds is not haram. Islamic investments adhere to the principles of Shariah law and involve no speculation or involvement of companies that deal in unethical activities such as gambling, alcohol, and tobacco. Some index funds may invest in non-compliant companies, so it is important to research and understand each fund before investing.

Conclusion

In conclusion, the best total stock market index funds can provide a fantastic way to diversify your portfolio and get the most bang for your buck regarding fee structure and exposure. With so many options on the market, it’s important to research which option works best for you. You should carefully consider the fund’s expense ratio when comparing it to its peers, as this will help determine how much money you can save over time with your investments.

-

Be a trader with the sense of defense

Nov 27, 2023

-

Stocks in Electric Car Manufacturers

Jan 23, 2024

-

How Do Stock Exchanges Value IPOs?

Nov 03, 2023

-

How to Build Credit with Secured Credit Card Rapidly

Feb 04, 2024

-

Cracking the Code: Maximizing Credit Card Sign-Up Bonus Offers

Oct 15, 2023

-

Mutual Funds vs. Hedge Funds: An Overview

Feb 10, 2024

-

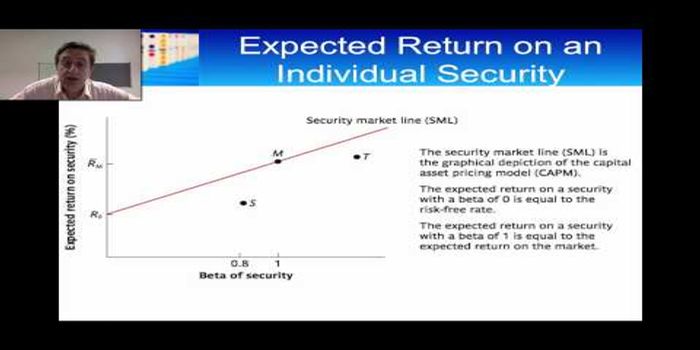

What is the Beta in a Stock's Risk?

Jan 09, 2024

-

Follow the leading ones in the mainstream stocks

Jan 05, 2024