Oct 15, 2023 By Susan Kelly

Welcome to the world of savvy credit card usage, where cracking the code can lead to exciting benefits and rewards. If you've ever wondered how to make the most of those tempting sign-up bonus offers, you're in the right place. In this guide, we'll walk you through the steps to maximize credit card sign-up bonuses and turn your plastic into a powerful tool for savings and perks.

Meeting Minimum Spending Requirements

Most credit cards require you to spend a certain amount within the first few months to qualify for the sign-up bonus. Plan your purchases strategically to meet these requirements without overspending. Consider using your credit card for everyday expenses or planned purchases to reach the minimum spending threshold.

Credit card issuers frequently update their sign-up bonus offers, so timing is crucial. Keep an eye out for limited-time promotions and special offers that can boost your initial bonus. Signing up during these promotional periods can significantly increase the value of your rewards.

Understanding Bonus Structures

Not all sign-up bonuses are created equally. Some credit cards offer straightforward cash bonuses, while others provide points or miles. Understand the bonus structure of your chosen card and how it aligns with your preferences. For instance, if you love to travel, a card that offers airline miles might be more valuable to you than a cash-back card.

Maintaining Good Credit Habits

Your credit score plays a crucial role in your ability to qualify for premium credit cards with generous sign-up bonuses. Let's break down some practical steps you can take to keep your credit in tip-top shape:

Pay Your Bills on Time:

Timely payments are the cornerstone of a healthy credit score. Set up reminders, use automatic payments, or create a budget to ensure that you never miss a due date. Even one late payment can have a negative impact on your credit score.

Understand Your Credit Report:

Regularly check your credit report for errors or discrepancies. You're entitled to a free annual credit report from each of the major credit bureaus. Reviewing your report helps you spot inaccuracies and address them promptly.

Keep Credit Card Balances Low:

Make an effort to keep your credit card balances significantly lower than your credit limit. Having high balances compared to your limit can have an adverse effect on your credit score. It's best to aim for a low credit utilization rate, ideally staying below 30%.

Utilizing Perks Beyond the Bonus

Credit cards often come with additional perks besides the sign-up bonus. These may include travel insurance, airport lounge access, or even statement credits for specific purchases. Familiarize yourself with these perks and take advantage of them to maximize the overall value of your credit card. Let’s have a look at some of the other perks offered by sign-up bonuses.

Instant Rewards Gratification:

Signing up for a credit card with a lucrative sign-up bonus is like an instant reward party. Unlike other rewards programs that require patience, sign-up bonuses often provide a quick boost to your account, allowing you to enjoy the benefits shortly after getting your new card.

Boosting Your Purchasing Power:

Credit card sign-up bonuses frequently come with a minimum spending requirement within the first few months. While this might seem like a hurdle, it actually boosts your purchasing power. It encourages you to use your credit card for planned expenses or everyday purchases, earning rewards along the way.

Travel Perks and Adventures:

Many credits card sign-up bonuses are tailored for travel enthusiasts. From airline miles to hotel points, these bonuses can transform your dream vacation into a reality. Imagine scoring a free flight or complimentary hotel stay—all thanks to the sign-up bonus you earned.

Cash Back for Everyday Spending:

If you prefer the simplicity of cash, there are credit cards that offer cash back as a sign-up bonus. This cash infusion can be a welcome addition to your budget, helping you cover expenses or even treat yourself to something special.

Elevated Rewards for Strategic Spending:

Sign-up bonuses often focus on specific spending categories, such as groceries, dining, or gas. This targeted approach allows you to maximize rewards in areas where you naturally spend more. It's like customizing your rewards to fit your lifestyle.

Additional Card Perks and Protections:

Beyond the initial sign-up bonus, credit cards often come with a suite of additional perks. These can include travel insurance, extended warranty protection, purchase assurance, and more. These extra benefits add value to your card and provide peace of mind.

Building a Credit Card Portfolio:

Successfully navigating and maximizing credit card sign-up bonuses can lead to building a diversified credit card portfolio. This, in turn, enhances your ability to earn rewards tailored to different aspects of your life, creating a well-rounded strategy for maximizing benefits.

Leveraging Limited-Time Offers:

Credit card issuers frequently introduce limited time offers and promotions to attract new cardholders. By staying informed and seizing these opportunities, you can score additional rewards that might not be available at other times. It's like catching a wave of extra perks.

Financial Flexibility and Convenience:

Using credit cards for strategic spending not only earns you rewards but also provides financial flexibility. It's a convenient way to make purchases, especially online, and can offer additional layers of security and fraud protection compared to other payment methods.

Wrapping It Up!

Cracking the code to maximize credit card sign-up bonuses is about more than just collecting rewards—it's about making your credit card work for you. By choosing the right card, timing your application strategically, and understanding the bonus structures, you can unlock a world of benefits and elevate your financial game. So, go ahead, dive into the world of credit card rewards, and start reaping the benefits of your newfound credit card mastery!

-

Mutual Funds vs. Hedge Funds: An Overview

Feb 10, 2024

-

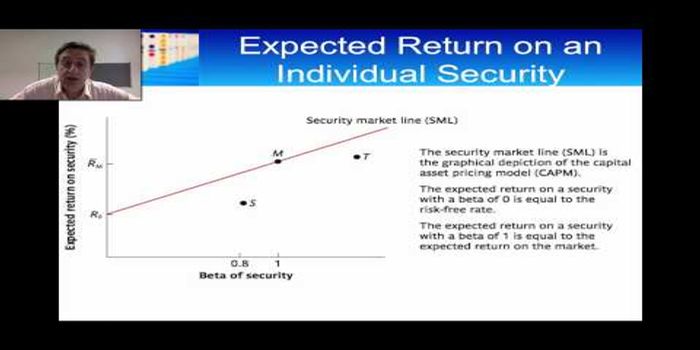

What is the Beta in a Stock's Risk?

Jan 09, 2024

-

Best Total Stock Market Index Funds

Oct 08, 2023

-

Capitalism that Takes Stakeholders Into Account

Jan 31, 2024

-

Investing in 3x ETFs Can Be Riskier Than You Think

Nov 23, 2023

-

Mobile Payment: Payments Made from a Smartphone or Tablet

Oct 11, 2023

-

Demystifying Minnesota Income Taxes for 2022-2023

Oct 15, 2023

-

Understanding Credit Card Annual Fees

Oct 16, 2023