Jan 23, 2024 By Triston Martin

Cars with electric motors sometimes called "electric vehicles," run on electricity rather than gasoline. Fuels such as gasoline and diesel are not necessary for electric vehicles. Stocks in electric vehicle manufacturers make up the majority of the sector. As a result, firms that produce electric car components, such as batteries or self-driving systems, are also part of the electric vehicle sector. It's fairly uncommon to see Ford and General Motors being referred to as "electric car companies" even though they're developing and manufacturing at least one type of electric vehicle.

1. Tesla: The industry leader

When it comes to electric vehicle stocks, you can't leave out Tesla. It was a great year for Elon Musk's electric vehicle firm in 2021. With 936,000 vehicles delivered by the end of the year, Tesla set a new record for its single-quarter output of 308,000 vehicles. Model 3 sedans and crossover SUVs made up the majority of the cars. Additionally, Tesla is currently making money without relying on regulatory credits. Moreover, one-third of the company's earnings came from regulatory credits in 2021, when net income reached $5.5 billion, up from just $721 million in 2020.

2. NIO: A Chinese SUV Specialist

Several initial public offers by other Chinese electric vehicle manufacturers, such as Li Automotive and Xpeng, have raised investor interest in Chinese electric car company NIO since its initial public offering in September 2018. Because of supply chain challenges, NIO only delivered 6,131 vehicles in February, a 9.9 percent increase from the previous year.

More than 182,000 of the business's ES8, ES6, and EC6 vehicles have been sold, and the company expects to begin delivering its ET7 sedan in early 2022. NIO aims to compete with Tesla's Model Y crossover SUV in the Chinese electric SUV market.

3. Rivian: A Lot To Prove

When Rivian, an electric vehicle manufacturer, went public in late 2021, investors were ecstatic. In one of the most successful U.S. IPOs, the business raised nearly $12 billion in new capital. Rivian's market value surged to $150 billion as soon as it went public. When Rivian went public, the company had yet to ship any of its electric trucks or SUVs, so investing in the stock was a huge risk. A total of more than a thousand automobiles were produced by the firm in 2021. Rivian has about 70,000 preorders at this time. These orders, on the other hand, are refundable. Thus they may not reflect the genuine demand for the company's automobiles.

Other EV Tech Stocks

Consider Lordstown Motors, which makes electric pickup trucks, and Workhorse, which makes electric delivery vans. However, both firms are grappling with certain challenges. A complete reversal from the company's prior statements, Lordstown said last year that it lacked the funds to launch its Endurance vehicle commercial manufacturing. There will only be 500 automobiles produced this year when the firm switches to contract production.

ETFs For Electric Vehicle

ETFs allow investors to have exposure to the electric car sector without choosing individual stocks. Electric car ETFs are many, but none are pure investments in electric vehicles. However, even though no company makes up more than 10% of the ETF, this ETF holds several electric carmakers. WilderHill's holdings include NIO, Tesla, Workhorse, Kandi, and Electra Meccanica Vehicles.

What Distinguishes The Electric Vehicle Industry?

Because the electric car sector is so new and distinct from the traditional automotive industry, there were just a few electric car manufacturers until recently. Still, every major automaker is either developing or manufacturing an EV. As a result of the current surge in EV demand, Tesla is the only acknowledged industry leader. Traditional automakers and start-up EV producers may fight successfully for EV market share, making it difficult to predict which firms will ultimately dominate the electric vehicle industry. Electric car investments are riskier than investments in the automotive sector because of their unpredictability.

Future Of Electric Cars

As part of the US infrastructure bill enacted into law late last year, financing for EV charging was included in the final package. A total of $5 billion will go to the states, with an extra $2.5 billion set out for grants to help them establish a nationwide network of restrooms. This multi-billion-dollar investment in charging infrastructure should help increase the popularity of electric vehicles in the long run.

Several firms are going public in the electric car market, and traditional automakers expect to introduce many electric vehicles in the next five years. Investors should take precautions to reduce investment risk in this highly competitive and fast-growing business. Don't only invest in one electric vehicle firm, but diversify your portfolio by holding interests in several smaller companies and an ETF.

-

Demystifying Payroll Tax Rates: Your Guide to Financial Understanding

Oct 15, 2023

-

Unlock Your Travel Potential: Best United Airlines Credit Cards

Oct 09, 2023

-

Revving Up the Future: The 10-Year Extension and Upgrades to the EV Charger Tax Credit

Oct 15, 2023

-

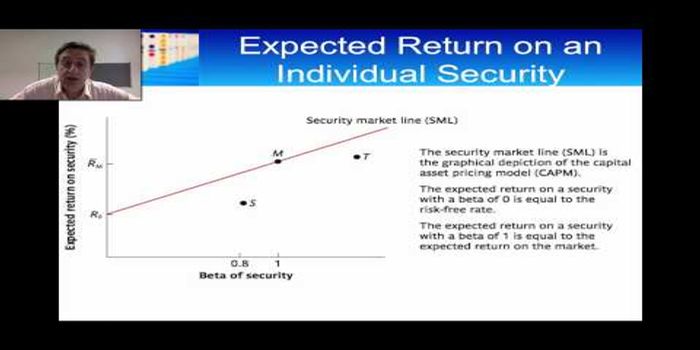

What is the Beta in a Stock's Risk?

Jan 09, 2024

-

All About Pricing Your Rental Property

Oct 04, 2023

-

Choosing the Best Mortgage Lender: CitiMortgage or Chase Bank Mortgage?

Oct 17, 2023

-

An Essential Guide About: What Is Real Estate Investing?

Feb 08, 2024

-

Different Kinds of Trusts

Feb 13, 2024

-

The 25 Most Valuable Stocks in the S and P 500 Index

Oct 27, 2023

-

Mobile Payment: Payments Made from a Smartphone or Tablet

Oct 11, 2023

-

Invest in the Russell 3000

Oct 16, 2023

-

Deposit Cash Online Bank

Oct 10, 2023