Dec 05, 2023 By Triston Martin

Are you a self-employed entrepreneur trying to find the best accounting software for your business? With dozens of options on the market, from time-tested mainstays to more innovative solutions that leverage cloud technology, making an informed decision can seem overwhelming.

Don’t worry - we’ve done all the hard work and compiled our comprehensive list of the best self-employed accounting software.

Our detailed analysis reveals which features are available with each program, so you can quickly decide what solution is right for your business. Read on to discover how simple it can be to set up and manage your finances!

QuickBooks Self-Employed

QuickBooks Self-Employed is one of the best self-employed accounting software packages available. It is designed to easily help self-employed individuals track income, expenses, and other financial information.

The software also offers tax filing solutions so users can file taxes quickly and accurately. With features such as bank reconciliation, invoicing, mileage tracking, and reports, QuickBooks Self-Employed helps entrepreneurs make sense of their finances and maximize deductions come tax season.

Moreover, the app is cloud-based, so you can access it anytime. QuickBooks Self-Employed streamlines accounting tasks for easy management of business finances. This is the perfect software if you're a freelancer or sole proprietor.

FreshBooks

FreshBooks is one of the best self-employed accounting software options available. It helps you streamline your business finances, making it easy to invoice clients, track expenses, and manage payments.

With FreshBooks, you'll get access to detailed reports and analytics that help you understand the financial health of your business. Additionally, their online bookkeeping services make it easy to stay organized even when you're on the go.

As a bonus, FreshBooks includes support from experienced accountants who can answer all your questions about taxes or other financial matters quickly and easily. With its intuitive interface and comprehensive features, FreshBooks makes running a business easier.

Wave Accounting

Wave Accounting is one of the best self-employed accounting software solutions available. The system provides users with a comprehensive suite of features to help them keep track of their finances and run their businesses more efficiently.

Wave Accounting also offers an intuitive user interface that makes it easy for anyone to navigate, regardless of experience or technical knowledge. The software lets you enter income and expenses, manage invoices, view financial reports, create budgets, and connect with other accounting programs like QuickBooks.

It also offers security features such as password protection and two-factor authentication so your data remains safe from unauthorized access. Wave Accounting is worth considering if you’re looking for a trusted solution to handle your accounting needs.

Zoho Books

Zoho Books is one of the best self-employed accounting software options available. It has a user-friendly interface, and a range of features enable businesses to track and manage their finances quickly and easily.

The software provides users with tools to streamline invoicing, monitor expenses, automate recurring payments, access real-time financial data, and more. Additionally, Zoho Books can be integrated with other third-party services such as PayPal or QuickBooks, for even greater convenience.

With this comprehensive offering, Zoho Books makes it easy for businesses of all sizes to take control of their finances in one platform.

Xero Accounting Software

Xero is one of the best self-employed accounting software offerings available. Its easy-to-use platform offers a comprehensive suite of features, including invoicing, inventory tracking, and bank reconciliation.

Xero’s intuitive mobile app also makes managing your finances on the go convenient and efficient. Overall, Xero provides an excellent service to help you stay organized and easily track your financials. It can save you time to focus on growing your business or simply taking care of your accounts in a secure environment.

Whether you’re just starting as a freelancer or running a small business, Xero can be an invaluable asset to streamline all aspects of accounting-related work.

GoDaddy Bookkeeping

GoDaddy Bookkeeping is one of the best self-employed accounting software solutions available today. It offers comprehensive features to help small business owners keep their finances organized and up-to-date.

The cloud-based platform allows you to easily track income, expenses, payments, taxes, invoices, and more in one secure place. Additionally, its integrations with popular payment systems make it easier than ever to accept payments from customers while keeping financial information organized.

With GoDaddy Bookkeeping’s custom reporting tools, users can quickly generate detailed reports to better manage their finances. By streamlining the bookkeeping process from start to finish, users can save time and money that would otherwise be spent on manual data entry or complex accounting software.

GoDaddy Bookkeeping is an excellent tool for those seeking insight into their finances and making better-informed decisions. This self-employed accounting system is easy to use, secure, and highly recommended by industry professionals.

Kashoo Accounting

Kashoo Accounting Software is one of the top solutions for self-employed professionals who need easy-to-use and comprehensive accounting software. With Kashoo, users can quickly and easily manage their finances, including tracking income, expenses, and invoices.

Additionally, Kashoo includes a powerful dashboard that gives you an insightful overview of your financial data. Furthermore, Kashoo offers integration with popular services like PayPal and Stripe. This makes it easier than ever to accept customer payments while staying on top of your cash flow.

All in all, Kashoo is one of the best self-employed accounting software available today. Its easy-to-use interface makes it great for those unfamiliar with bookkeeping or accounting processes.

Its advanced features are great for those who need more accurate and detailed financial analysis. Plus, it integrates with popular services that make managing your finances a breeze.

Sage Business Cloud Accounting

Sage Business Cloud Accounting is one of the best self-employed accounting software solutions available today. This cloud-based system allows you to access all your financial data from any device and keep track of your expenses, bills, income, and cash flow in an organized manner.

Sage also offers helpful features such as automated invoice reminders, bank reconciliation tools, and tax filing support so that you can manage your finances more efficiently.

Furthermore, its budgeting capabilities help you stay on top of your spending while giving insights into where money needs to be allocated next.

With Sage Business Cloud Accounting, it's easier than ever for self-employed professionals to stay on top of their finances and run a successful business.

FAQs

Can I use QuickBooks instead of an accountant?

Yes, QuickBooks is one of the best self-employed accounting software options. It can help you track income and expenses, create invoices, manage taxes, and more.

What other self-employed accounting software options are available?

There are multiple accounting programs for self-employed users on the market today. From cloud-based solutions such as Xero or Wave to desktop programs like FreshBooks or Sage 50cloud Accounting—many robust programs will provide valuable insights into your business finances.

How do I choose the best self-employed accounting software?

The best self-employed accounting software for you will depend on your needs and preferences. When deciding, consider factors such as ease of use, features, integrations with other business tools, customer service availability, and price.

Additionally, research customer reviews to find out what experiences other users have had. That information lets you decide which self-employed accounting software is right for you.

Conclusion

There are a variety of accounting software solutions for anyone wanting to take hold of their financial freedom. Choosing the right accounting software boils down to individual needs and preferences.

QuickBooks Self-Employed, FreshBooks, Wave Accounting, Zoho Books, Xero Accounting Software, GoDaddy Bookkeeping, Kashoo Accounting, and Sage Business Cloud.

Accounting are each outstanding solutions in their unique way. Whatever you choose as your self-employed accounting captain, each will surely steer you toward fruitful financial success!

-

Choosing the Best Mortgage Lender: CitiMortgage or Chase Bank Mortgage?

Oct 17, 2023

-

An Essential Guide About: What Is Real Estate Investing?

Feb 08, 2024

-

Best Self-Employed Accounting Software

Dec 05, 2023

-

Everything you Need to Know about Best Credit Cards for Authorized Users

Oct 15, 2023

-

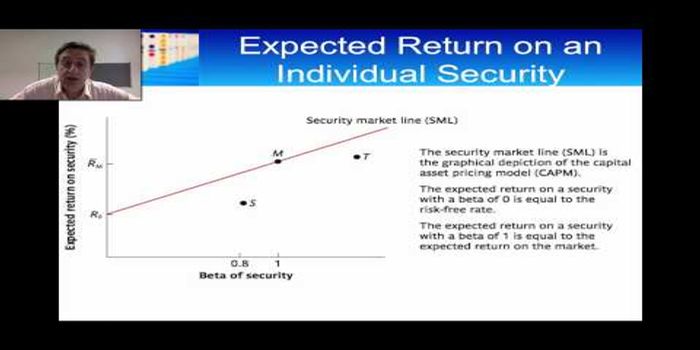

What is the Beta in a Stock's Risk?

Jan 09, 2024

-

Demystifying Payroll Tax Rates: Your Guide to Financial Understanding

Oct 15, 2023

-

Deposit Cash Online Bank

Oct 10, 2023

-

How to Consolidate a Bad Credit Debt?

Feb 26, 2024