Oct 15, 2023 By Triston Martin

When it comes to traveling, every penny saved counts. Frequent flyers and jet-setters understand the importance of finding ways to make their journeys more affordable and rewarding. One effective strategy is to leverage credit cards that offer in-flight savings and bonuses.

These specialized credit cards help you save on airfare and provide a host of travel-related perks that can elevate your travel experience. In this article, we'll dive into the world of credit cards that cater to travelers, highlighting the top options and explaining how they can benefit you.

The World of Travel Credit Cards

Travel Credit Cards have become increasingly popular, and for good reason. They are designed to reward you for your travel-related expenses and offer a wide range of benefits, including in-flight savings, airport lounge access, and travel insurance. Here are some key features to look for in a travel credit card:

Airline Partnerships

One of the most important aspects of a travel Credit Card is its airline partnerships. Through these collaborative partnerships, you can accumulate miles or points with redeemable value for flights on designated airlines. Look for a card that partners with airlines that align with your travel preferences.

Travel Rewards

Travel Credit Cards typically offer rewards in the form of miles or points. You can accumulate these rewards through everyday purchases, which can later be redeemed for airfare, hotel accommodations, or other travel-related expenses. The more you spend, the more rewards you can accumulate.

Travel Perks

In addition to rewards, Travel Credit Cards often come with various travel perks. These may include free checked bags, priority boarding, and access to airport lounges. These perks can significantly enhance your travel experience.

Annual Fees

Many Travel Credit Cards charge an annual fee, so weighing the benefits against the cost is important. Some premium cards offer substantial rewards and benefits that justify the annual fee, while others may not be as cost-effective.

Top Credit Cards for In-flight Savings & Bonuses

Now that we've covered the basics of Travel Credit Cards let's explore some of the best options available for in-flight savings and bonuses:

Chase Sapphire Reserve

The Chase Sapphire Reserve is a premium travel Credit Card known for its exceptional benefits. With this card, you'll earn 3X points on travel and dining purchases worldwide. Points can be transferred to various airline and hotel partners, providing flexibility in your travel plans.

The card offers a $300 annual travel credit, Global Entry/TSA PreCheck fee reimbursement, and Priority Pass lounge access.

American Express Platinum Card

The American Express Platinum Card is another premium choice for travelers. Cardholders enjoy 5X points on flights booked directly with airlines or through American Express Travel.

The card provides access to over 1,200 airport lounges worldwide, including Centurion Lounges and Priority Pass lounges. Additional benefits include up to $200 in airline fee credits and a $100 credit for Global Entry/TSA PreCheck.

Citi Premier® Card

The Citi Premier® Card boasts a robust rewards program, delivering 3X points for air travel and hotel expenses, 2X for dining and entertainment, and 1X for all other expenditures. Points can be transferred to various airline partners.

Cardholders also receive a $100 annual hotel savings benefit and no foreign transaction fees, making it a great choice for international travel.

Capital One Venture Rewards Credit Card

The Capital One Venture Rewards Credit Card is known for its simplicity and flexibility. Cardholders earn 2X miles on every purchase, and miles can be redeemed for statement credits on travel expenses.

There are no blackout dates or restrictions when booking flights, making it easy to use your miles for in-flight savings. Additionally, this card offers up to a $100 credit for Global Entry/TSA PreCheck.

Maximizing In-flight savings

Once you've chosen the right travel credit card, it's essential to understand how to maximize your in-flight savings and bonuses. Here are some strategies to make the most of your card's benefits:

Plan Your Travel Carefully

To maximize your rewards, plan your travel around your card's benefits. Use your card to book flights directly with partner airlines and take advantage of additional perks, such as priority boarding and lounge access.

Take Advantage of Sign-Up Bonuses

Many Travel Credit Cards offer generous sign-up bonuses for new cardholders. These bonuses often include many miles or points after meeting a minimum spending requirement. Be sure to meet these requirements to unlock valuable rewards.

Use Travel Credits Wisely

If your card offers an annual travel credit, use it effectively. This credit can offset the card's annual fee and provide substantial savings on travel-related expenses.

Keep an Eye on Promotions

Travel Credit Card issuers often run promotions and special offers. These may include bonus miles for specific purchases or discounts on travel-related expenses. Stay informed about these promotions to make the most of your card.

Tips for Responsible Credit Card Usage

While credit cards with in-flight savings and bonuses can be incredibly rewarding, using them responsibly is essential. Here are some tips to ensure you make the most of your card while maintaining your financial health:

Pay Your Balance in Full

Aim to pay your Credit Card balance in full each month to avoid high-interest charges. This practice will also help you maintain a good credit score.

Set a Budget

Create a budget for your Credit Card spending and stick to it. Knowing your limits will prevent you from overspending and accumulating debt.

Avoid Cash Advances

Cash advances on credit cards often come with high fees and interest rates. It's best to avoid them unless necessary.

Monitor Your Statements

Regularly review your Credit Card statements for any unauthorized or incorrect charges. Promptly report any issues to your card issuer.

Conclusion

In summary, credit cards that offer in-flight savings and bonuses can be a game-changer for frequent travelers. They provide various benefits, from earning valuable rewards to enjoying travel perks like lounge access and priority boarding. When choosing a travel credit card, consider your travel preferences and spending habits to find the one that suits you best.

With the right card and a strategic approach to earning and redeeming rewards, you can enhance your travel experience while saving money. Happy travels!

-

All About Pricing Your Rental Property

Oct 04, 2023

-

Getting Approved for a Mortgage: Mortgage Pre-Approval Checklist

Oct 13, 2023

-

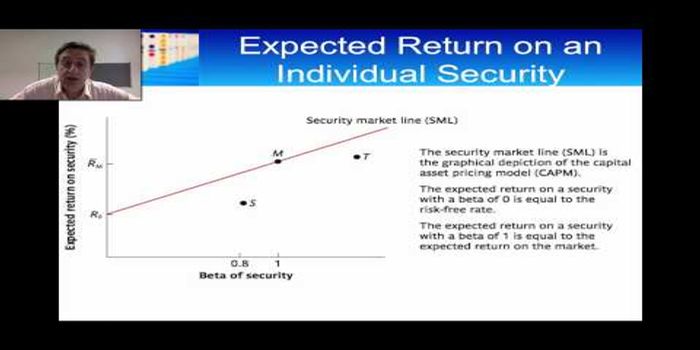

What is the Beta in a Stock's Risk?

Jan 09, 2024

-

Choosing the Best Mortgage Lender: CitiMortgage or Chase Bank Mortgage?

Oct 17, 2023

-

Men’s Wearhouse Perfect Fit Credit Card

Oct 13, 2023

-

Stocks in Electric Car Manufacturers

Jan 23, 2024

-

Credit Cards That Offer In-Flight Savings and Bonuses

Oct 15, 2023

-

Trust Work When Someone Dies

Nov 27, 2023