Feb 08, 2024 By Triston Martin

Introduction

Making a profit through the administration, acquisition, letting, and selling of real estate is known as "real estate investment." Despite the diversity of real estate investment strategies, they all rely on the same underlying economic principles to generate returns. The first requirement is that the property's value should rise. The second is that the value appreciation of the property should not be less than the cost of ownership and maintenance.

Some investors prefer short-term gains, while others are more interested in the long-term stability of owning various investment properties. The term "flipping" refers to the practice of investing in real estate to sell it for a profit quickly. Buying real estate to rent it out over a long period, profiting from rent, and appreciating the property's value are examples of long-term investment strategies. Investing in real estate projects is made easier with the help of online real estate marketplaces.

How Should You Go About It?

If you're a newcomer to the world of real estate investing, you might be concerned that you don't know enough about investing in Pakistani property. And yet, there is no cause for alarm there. Any investor can succeed in the Pakistani real estate market by following a few easy steps. You will be well on making some once you have mastered them.

Determine Your Requirements

Your initial step as an investor should be to consider your objectives carefully. Considering how long you plan to keep an investment before selling would be best. You should also determine your exact budget before beginning market research. It would be best if you also chose whether or not you want to put your money into the city where you currently reside.

Do Your Research

When you know what you need, you can start looking into properties that meet those criteria. Make use of many different tools for this task. The best projects to invest in Pakistan's real estate market can be found by searching through the top property portal in the country, Zameen.com. Also, check to see that the project you're considering has been granted the necessary permits.

You can confirm this by contacting the local planning department in the prospective location. Discussing price and demand movements with multiple brokers is also recommended. An estimate of future price growth for your home can be derived from these numbers. If you put in the time and effort, you might be able to crack your own "how to invest in real estate with little money" code.

Buy Your Property

After you've done some market legwork and settled on a few potential properties in Pakistan, it's time to make a purchase. Be mindful of all legalities and have an attorney's appropriate transfer and sales deeds reviewed. Think about the plot's or house's location and current state of construction as well. Your property's rate increases significantly depending on these aspects. Never risk losing your money by investing in a piece of real estate that hasn't been given the stamp of approval by the appropriate government agencies.

Means of Earning Through Real Estate

There is more than one way to profit from real estate. Below are some of the most important real estate investment strategies:

Appreciation of Property Value

Investing in real estate is typically a good idea because property value keeps increasing even in the situation of inflation in the economy. Renting out your home or business is a great way to build a passive income stream over time.

Related Commission

Property managers, agents, and brokers in the real estate industry can earn commissions by facilitating transactions between buyers and sellers.

Income from Ancillary Real Estate Investment

It is possible to supplement one's primary sources of income, such as a business or salary, in several ways. Adding a vending machine to a fully functional workplace is one such option.

Conclusion

Property ownership is a rewarding and potentially lucrative investment strategy. Real estate investors can build a strong investment portfolio by paying only a small fraction of the total value of each property at the outset, whether they intend to use the properties for rental income or are simply waiting for the right selling opportunity to present itself. And just like any other investment, there is opportunity and profit to be had in real estate whether the market as a whole is up or down.

The risks associated with crowdfunding may make it less attractive for some investors. Many people don't realise this because crowdfunding for real estate is still so novel. In addition, some of the projects listed on crowdfunding sites may have appeared there because they could not obtain funding through more conventional channels.

-

Be a trader with the sense of defense

Nov 27, 2023

-

Follow the leading ones in the mainstream stocks

Jan 05, 2024

-

The 25 Most Valuable Stocks in the S and P 500 Index

Oct 27, 2023

-

Cracking the Code: Maximizing Credit Card Sign-Up Bonus Offers

Oct 15, 2023

-

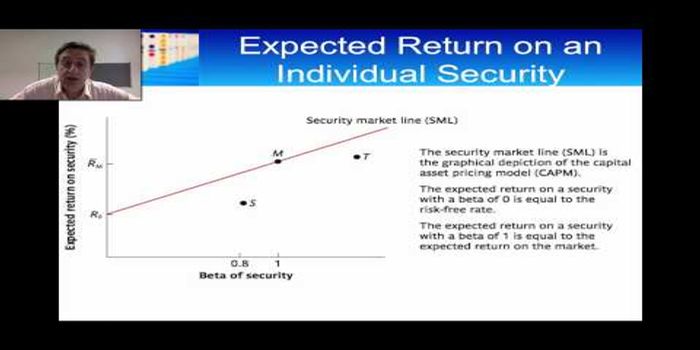

What is the Beta in a Stock's Risk?

Jan 09, 2024

-

Men’s Wearhouse Perfect Fit Credit Card

Oct 13, 2023

-

How to Build Credit with Secured Credit Card Rapidly

Feb 04, 2024

-

Stocks in Electric Car Manufacturers

Jan 23, 2024