Oct 27, 2023 By Triston Martin

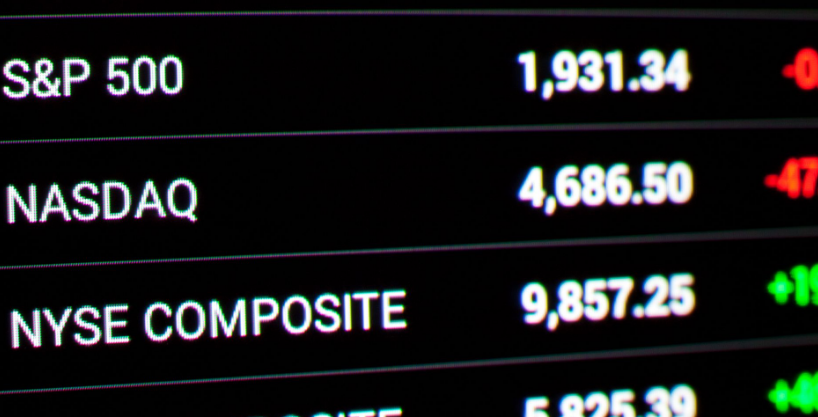

The S&P 500 is a stock market index that monitors the performance of the 500 largest American firms. This index represents more than 80% of the US stock market's total capitalization, making it a widely acknowledged measure of the market.

ETFs (Exchange Traded Funds) and mutual funds that reflect the S&P 500's component distribution. Before using this index to measure your investments, ensure you're familiar with the S&P 500's component companies.

John D. Rockefeller allegedly quipped, "The only thing that pleasure me is to see my riches coming in." As the wealthiest American ever, Rockefeller understood the long-term power of dividends. Income investors should do the same. Observe the best-performing stocks over the past 50 years. Bonuses were crucial in all but one of the cases, and even then, it was an infrequent occurrence.

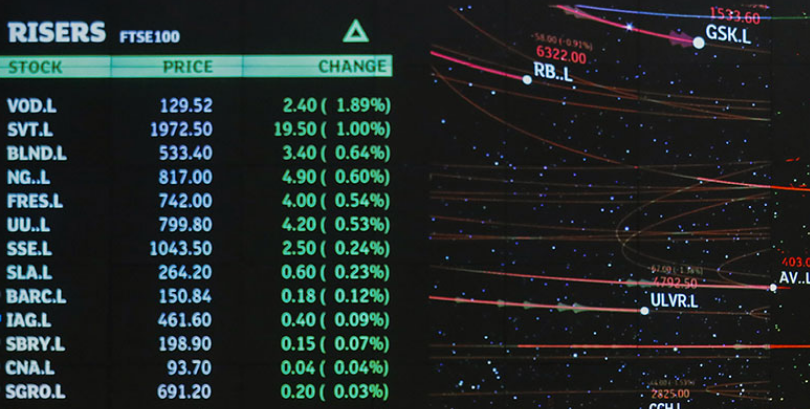

The top 25 S&P Dow Jones Indices stocks during the past 50 years are included in Standard & Poor's 500-stock index. Even after considering price growth, many of these companies' annualized returns were underwhelming.

On the other hand, these stocks outperformed the market in terms of total return (price appreciation plus dividends). Over the past 50 years, the S&P 500's annualized return, including tips, has been 9.5%. Compared to the best stock returns of all time, that's nothing. The best equities of the last 50 years illustrate that dividends are essential for long-term investors unless you're Warren Buffett (hint, hint).

Inclusion Criteria for the S&P 500

A vital stock market benchmark, the S&P 500, has been around since 1957. 500 S&P 500 firms are publicly traded. The S&P 500 index focuses on the large-cap segment of the United States stock market.

To be included in the S&P 500, a company must meet several requirements, including the following:

- Must be a U.S.-based firm

- At least 10% of the company's equity shares must be publicly traded.

- Earnings for the last four quarters in a row have been favorable.

- Earnings for the most recent quarter were positive.

- Liquidity standards must be met.

Calculation of the S&P 500 Index

The market capitalization-weighted index is the S&P 500. The total dollar market value of a company's outstanding equity shares is called market capitalization (or market cap). You multiply the outstanding shares by the current stock price to get at a company's market cap.

This means that the more a company's stock price appreciation, the more significant its contribution to the overall turn on the S&P 500 index. More often than not, only 50 to 75 equities account for three-quarters of the index's return.

As a result, the return on the index will be unaffected by the inclusion or exclusion of smaller companies. But even one of the more extensive stocks can significantly impact the removal or inclusion.

In the S&P 500, you'll find some of the most successful corporations in the United States, all of which serve as barometers for the overall state of the economy. Before being included in the S&P 500, companies must meet specific criteria set by the index's publishers. The market capitalization weighting of the S&P 500 index favors companies with larger market capitalizations.

To qualify for inclusion in the S&P 500, a stock must have a market capitalization of $14.6 billion and a public float of 10% of its outstanding shares. Departures from the S&P 500 guidelines may result in a company's expulsion.

Invest in the S&P 500 Through an Online Broker

Today, respectable online brokers such as Webull and eToro let investors place trades over the internet. The world's most popular indices are on the most regulated trading platforms. The vast majority of typical investor accounts lose money while trading indices. Don't gamble with money that you can't afford to lose.

Investing in the S&P 500 Index Funds is a wise decision

There are many benefits to investing in an S&P 500 Index Fund Warren Buffett recommends investing 10% of your retirement funds in short-term government bonds and 90% in ETFs that track the S&P 500 Index. The S&P 500 ETF is a mutual fund ETF that tracks the S&P 500 Index. The advantage of index funds is that they allocate your money to many high-quality stocks. You can benefit from investing in index funds because they are managed by experts who know how to maximize your results.

-

Best Total Stock Market Index Funds

Oct 08, 2023

-

Unveiling the Runway to Wealth: Investing in Fashion Stocks

Oct 17, 2023

-

Capitalism that Takes Stakeholders Into Account

Jan 31, 2024

-

Stocks in Electric Car Manufacturers

Jan 23, 2024

-

Credit Cards That Offer In-Flight Savings and Bonuses

Oct 15, 2023

-

Getting Approved for a Mortgage: Mortgage Pre-Approval Checklist

Oct 13, 2023

-

Investing in 3x ETFs Can Be Riskier Than You Think

Nov 23, 2023

-

Mobile Payment: Payments Made from a Smartphone or Tablet

Oct 11, 2023